Fast Cashing Services in Modern Business

Small businesses need reliable payment solutions today. Fast cashing services help entrepreneurs manage their daily transactions efficiently. These services ensure quick access to funds and seamless processing of payments. The modern market demands speed and reliability in financial transactions.

Digital technology has transformed business payment processing completely. New businesses can now access their funds within hours instead of days. Modern business payment systems offer enhanced security features for peace of mind. The integration of fast business payment solutions helps maintain steady cash flow.

Features of Small Payment Processing Solutions

- Seamless business integration

- High-speed transaction processing

- Multi-payment method support

- Advanced encryption for security

Benefits of Quick Payment Processing

Immediate access to funds improves business operations significantly. Fast services reduce the waiting time for payment clearance. Business owners can manage their expenses more effectively. The quick turnaround helps maintain healthy cash flow.

Enhanced customer satisfaction comes with faster processing. Clients appreciate quick and efficient payment solutions. The streamlined process reduces transaction complications. Businesses can focus more on growth and less on payment issues.

Choosing the Right Payment Service Provider

Research different service providers thoroughly before deciding. Compare the features of various fast cashing carefully. Look for providers with proven track records in the industry.

Customer support quality matters in payment processing. The provider should offer 24/7 technical assistance. Check the integration capabilities with your current systems. Review the security measures implemented by the provider.

Technology Behind Modern Payment Solutions

Advanced algorithms ensure quick transaction processing. Small payment processing systems use advanced technology. They ensure fast transactions and strong security. The infrastructure supports multiple payment channels effectively. Real-time monitoring prevents fraudulent activities.

Cloud-based solutions offer enhanced accessibility options. Mobile integration allows payments from any device. The system updates occur automatically for better security. Modern APIs enable smooth third-party integrations.

Cost Considerations and ROI

Investment in quality payment services pays off quickly. Calculate the potential returns before implementing new systems. Consider both immediate and long-term cost benefits. Factor in the savings from improved efficiency.

Transaction fees vary among different service providers. Some offer volume-based pricing for better value. Hidden costs should be identified and evaluated carefully. Compare different pricing models before making decisions.

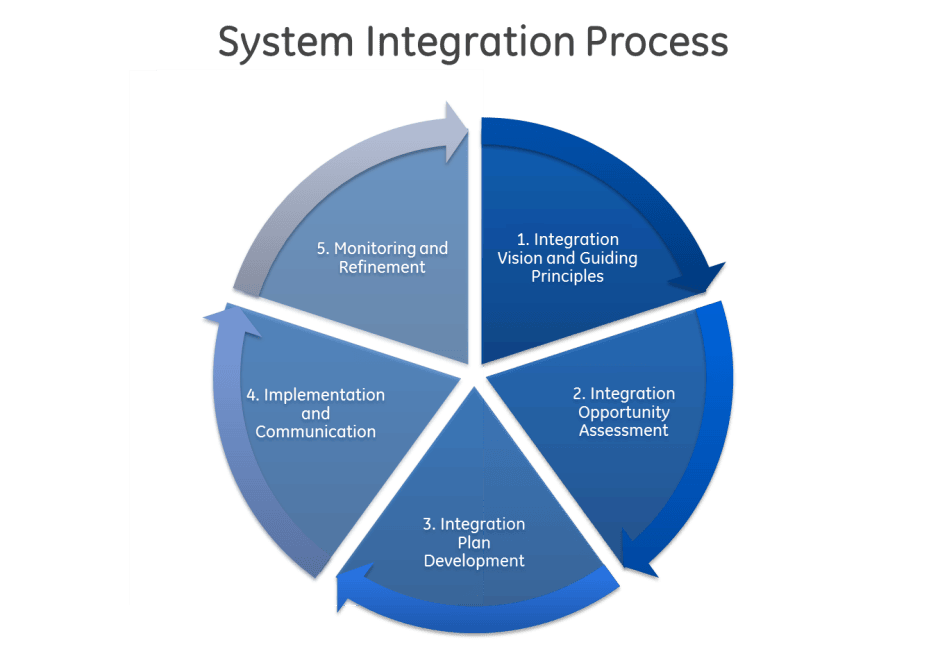

Implementation and Integration Process

Proper planning ensures smooth system implementation. The integration process requires careful coordination. Staff training helps maximize system effectiveness. Regular testing confirms proper system functionality.

Document all procedures for future reference. Create backup plans for possible system issues. Monitor the initial implementation phase closely. Make adjustments based on performance feedback.

Future of Payment Processing Technology

Innovation continues to shape payment processing systems. New technologies emerge to improve transaction speed. Security measures evolve to counter modern threats. Mobile payment solutions gain more importance daily.

Businesses must stay updated with technology changes. Artificial intelligence enhances payment processing capabilities. Blockchain technology offers new security possibilities. The future promises even faster and more secure transactions.

Maintaining Security in Payment Processing

Regular security audits protect business interests. Small processing systems need constant monitoring. Update security protocols according to the latest standards. Train staff about security best practices regularly.

Implement multi-factor authentication for all transactions. Keep customer data protected at all times. Monitor transaction patterns for suspicious activities. Respond quickly to security alerts and concerns.

Customer Experience Enhancement

Understanding customer payment preferences is crucial. Fast services should adapt to user needs. Regular feedback collection helps improve service quality. Customer satisfaction drives business success.

Mobile-friendly interfaces enhance user experience significantly. Multiple payment options provide customer convenience. Clear transaction receipts build trust and transparency. Quick resolution of payment issues maintains customer loyalty.

International Payment Processing

Global businesses need robust payment solutions. Cross-border transactions require special attention. Exchange rates affect international payment processing. Compliance with international regulations is essential.

Different countries have varying payment preferences. Local payment methods must be supported effectively. Time zone differences affect processing schedules. International support services are crucial for global operations.

Risk Management in Payment Processing

Effective risk assessment prevents financial losses. Small payment processing requires careful monitoring. Regular system updates minimize security risks. Staff training reduces human error risks.

Automated fraud detection systems provide protection. Real-time transaction monitoring identifies threats. Backup systems ensure business continuity. Regular risk assessments guide security improvements.

Mobile Payment Integration

Smartphone payments continue gaining popularity worldwide. Mobile wallets streamline payment processing significantly. Integration with existing systems ensures smooth operations. User-friendly interfaces encourage mobile adoption.

Security features protect mobile payment transactions. Biometric authentication adds extra protection layers. Real-time notifications keep users informed instantly. Mobile payment analytics provide valuable insights.

Regulatory Requirements

Industry standards ensure transaction security consistently. Regular audits verify compliance requirements. Documentation helps maintain regulatory adherence Training staff about compliance is essential. Updates to regulations require quick adaptations. Partnerships with regulatory experts provide guidance. Compliance failure risks serious consequences.

Data Analytics and Reporting

Transaction data provides valuable business insights. Small processing generates useful analytics. Regular reporting helps track business performance. Data-driven decisions improve operations significantly.

Custom reports meet specific business needs. Real-time dashboards show important metrics instantly. Historical data helps predict future trends. Analytics tools support business growth effectively.

Disaster Recovery Planning

Backup systems prevent service interruptions. Fast cashing services need reliable recovery plans. Regular testing ensures system reliability. Staff training covers emergency procedures thoroughly.

Alternative processing methods provide backup options. Data backups protect important information. Recovery time objectives guide planning efforts. Regular plan updates maintain effectiveness.

Payment Gateway Selection

Security features determine gateway reliability. Fast services need robust gateway support. Gateway integration affects processing speed significantly. Compatibility with existing systems matters greatly.

Multiple gateway options provide better flexibility. Transaction volume affects gateway selection decisions. Gateway costs impact overall processing expenses. Regular gateway performance reviews ensure efficiency.

Customer Support Systems

Professional support enhances service quality. Small payment processing requires dedicated assistance. Support teams need proper training resources. Quick response times improve customer satisfaction.

Multi-channel support meets diverse needs effectively. Support documentation helps solve common issues. Performance metrics track support quality regularly. Customer feedback guides support improvements continuously.

Performance Monitoring Systems

Real-time monitoring ensures optimal performance. System alerts prevent potential problems quickly. Performance metrics guide improvement efforts effectively. Regular reports show system health clearly.

Monitoring tools track transaction success rates. Speed measurements ensure processing efficiency. Error tracking helps prevent future issues. Performance optimization occurs continuously.

Integration with Accounting Systems

In the Fast cashing services, seamless accounting integration saves time. Automated reconciliation reduces manual work. Transaction records update automatically daily. Financial reporting becomes more accurate.

Integration reduces bookkeeping errors significantly. Accounting workflows improve with automation. Real-time financial data supports decisions. System compatibility ensures smooth operations. If you want to know more about Business! Stay with us.